What is a Crypto Wallet? A Beginner’s Guide

Hot wallets vs cold wallets. Custodial or

non-custodial. If you are confused by the different types of crypto wallets on

the market, you have come to the right place.

Key Takeaways

- Contrary to

popular belief, crypto wallets do not physically hold cryptocurrencies

like the wallet in your pocket

- Instead, they

store the public and private keys required to buy cryptocurrencies and

provide digital signatures that authorise each transaction

- There are

several types of crypto wallets including physical devices, software, and

even paper

- Determining

which crypto wallet is best for you depends entirely on your individual

trading needs

What is a Crypto Wallet?

Cryptocurrency

wallets store users’ public and private keys while providing an easy-to-use

interface to manage crypto balances. They also support cryptocurrency transfers

through the blockchain.

Some wallets even allow users to perform certain actions with their crypto

assets such as buying and selling or interacting with decentralised

applications (DApps).

It

is important to remember that cryptocurrency transactions do not represent a

‘sending’ of crypto tokens from your mobile phone to someone else’s mobile

phone. When you are sending tokens, you are actually using your private key to

sign the transaction and broadcast it to the blockchain network. The network

will then include your transaction to reflect the updated balance in your

address and the recipient’s.

So,

the term ‘wallet’ is actually somewhat of a misnomer as crypto wallets don’t

really store cryptocurrency in the same way physical wallets hold cash.

Instead, they read the public ledger to show you the balances in your addresses

and also hold the private keys that enable you to make transactions.

Not sure what a public

or private key is?

A

key is a long string of random, unpredictable characters. While a public key is

like your bank account number and can be shared widely, your private key is

like your bank account password or PIN and should be kept secret. In public-key

cryptography, every public key is paired with one corresponding private key.

Together, they are used to encrypt and decrypt data.

Why You Need a Crypto Wallet

Your

cryptocurrency is only as safe as the method you use to store it. While you can

technically store crypto directly on the exchange, it is not advisable to do so

unless in small amounts or if you plan to trade them frequently.

For

larger amounts, it’s recommended that you withdraw the majority to a crypto

wallet, whether that be a hot wallet or a cold one. This way, you retain

ownership of your private keys and have full power and control over your own

finances.

How do Cryptocurrency Wallets Work?

As

mentioned earlier, a wallet doesn’t actually hold your coins. Instead, it holds

the key to your coins which are

actually stored on public blockchain networks.

In

order to perform various transactions, you’ll need to verify your address via a

private key that comes in a set of specific codes. The speed and security often

depend on the kind of wallet that you have.

Different Types of Crypto Wallets

There

are two main types of crypto wallets: software-based hot wallets and physical

cold wallets. Read on to learn about the different types of cryptocurrency

wallets, and which is best for you and your needs.

Hot and Cold Wallets – What’s the Difference?

Hot Wallets

The

main difference between hot and cold wallets is whether they are connected to

the Internet. Hot wallets are

connected to the Internet, while cold wallets are kept offline. This means

that funds stored in hot wallets are more accessible, and are easier for

hackers to gain access to.

Examples of hot wallets

include:

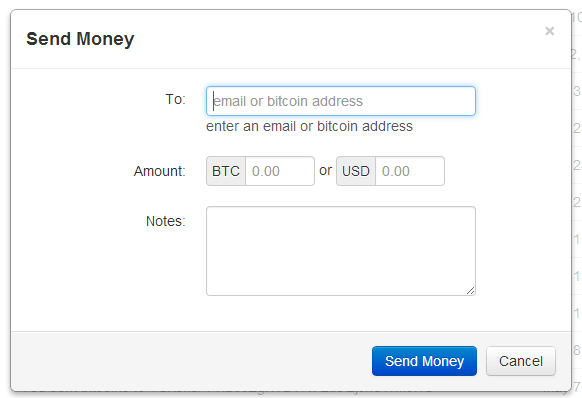

- Web-based

wallets

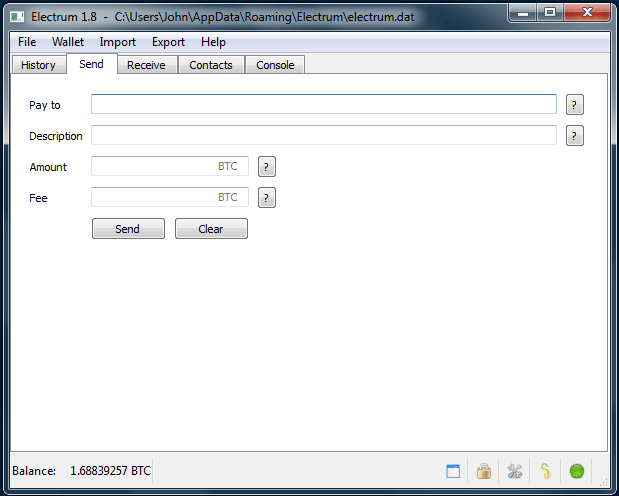

- Mobile wallets

- Desktop wallets

In

hot wallets, private keys are stored and encrypted on the app itself, which is

kept online. Using a hot wallet can be risky because computer networks have

hidden vulnerabilities that can be targeted by hackers or malware programs to break

into the system. Keeping large amounts of cryptocurrency in a hot wallet is a

fundamentally poor security practice, but the risks can be mitigated by using a

hot wallet with stronger encryption, or by using devices that store private

keys in a secure enclave.

There

are different reasons why an investor might want their cryptocurrency holdings

to be either connected or disconnected from the Internet. Because of this, it’s

not uncommon for cryptocurrency holders to have multiple cryptocurrency

wallets, including both hot and cold wallets.

Cold Wallets

As

introduced at the beginning of this section, a cold wallet is entirely offline.

While they’re certainly not as convenient as hot wallets, they are far more

secure. An example of a physical medium used for cold storage is a piece of

paper or an engraved piece of metal.

Examples of cold

wallets include:

- Paper wallets

- Hardware

wallets

What is a Paper Wallet?

A

paper wallet is a physical location where the private and public keys are

written down or printed. In many ways, this is safer than keeping funds in a

hot wallet, since remote hackers have no way of accessing these keys which are

kept safe from phishing attacks. On the other hand, it opens up the potential

risk of the piece of paper getting destroyed or lost, which may result in

irrecoverable funds.

What is a Hardware Wallet?

A

hardware wallet is an external device (usually a USB or Bluetooth device) that

stores your keys. You can only sign a transaction by pushing a physical button

on the device, which malicious actors cannot control.

For

any cryptocurrency assets that you do not need instant access to, the best

practice is to store them offline in a cold wallet. However, users should note

that this also means that securing your assets is

entirely your own responsibility. So it’s up to you to make sure that you

don’t lose it or have it stolen!

Tip: For increased security, separate

your public and private keys, keep them offline, and store your physical wallet

in a safe deposit box.

Hot Wallets vs Cold Wallets: Which is Better?

While

both methods of storage have benefits and drawbacks, the option you choose will

depend on what you are looking for. For example:

- If you plan to

trade day-to-day, then accessibility will be of paramount importance,

meaning that a hot wallet is probably an apt choice.

- However, if you

are considering storing a huge amount of crypto assets and value security

over convenience, then it might be wise to invest in a cold wallet.

Custodial and Non-Custodial Wallets

In

addition to the wallets mentioned above, wallets can be further separated into

custodial and non-custodial types.

Custodial Wallets

Most

web-based crypto wallets tend to be custodial wallets. Typically offered on

cryptocurrency exchanges, these wallets are known for their convenience and

ease of usage, and are especially popular with newcomers, as well as

experienced day traders.

The

main difference between custodial wallets and the types mentioned above is that

users are no longer in full

control of their tokens, and the private keys needed to sign for

transactions are held only by the exchange.

The

implication here is that users must trust the

service provider to securely store their tokens and implement strong security

measures to prevent unauthorised access. These measures include two-factor authentication,

email confirmation, and biometric authentication, such as facial recognition or

fingerprint verification. Many exchanges will not allow you to make

transactions until these security measures are properly set up by the user.

Exchanges

and custodial wallet providers will usually also take further steps to ensure

the safety of users’ tokens. For example, a portion of the funds is usually

transferred to the company’s cold wallet, where they can be safe from online

attackers.

At Crypto.com, we have taken many measures to ensure the protection of customer funds. After rigorous

security audits by a team of cybersecurity and compliance experts, Crypto.com

is the first crypto company in the world to have obtained ISO/IEC 27701:2019,

ISO22301:2019, ISO27001:2013

and PCI:DSS 3.2.1, Level 1 compliance, and independently assessed at Tier 4,

the highest level for both NIST Cybersecurity and Privacy Frameworks, as well

as Service Organization Control (SOC) 2 compliance.

Additionally,

we have in place a total of US$360 million for insurance protection of customer

funds.

Non-Custodial Wallets

Non-custodial

wallets, on the other hand, allow you to retain full control of your funds

since the private key is stored locally with the user.

When

starting a non-custodial wallet, you will be asked to write down and safely

store a list of 12 randomly generated words, known as a ‘recovery’, ‘seed’, or

‘mnemonic’ phrase. From this phrase, all of your public and private keys can be

generated. This acts as a backup or a recovery

mechanism in

case you lose access to your device.

Anyone

with the seed phrase will be able to gain full control of the funds held in

your wallet. In a case scenario where the seed phrase is lost, you will lose

access to your funds. So it is imperative to keep the mnemonic phrase in a

secure location, and to not store a digital copy of it anywhere! Do not print

it out at a public printer or take a picture of it with your phone.

Note

that hardware wallets are inherently non-custodial since private keys are

stored on the device itself. There are also software-based non-custodial

wallets, such as the Crypto.com Wallet. The common theme here is that the

private keys and the funds are fully in users’ control. As the popular

saying within the crypto community goes, ‘not your keys, not your coins!’

On

the flip side, however, this means that users must be in charge of their own

security, with regard to the storage of passwords and seed phrases. If any of

these are lost, recovery can be difficult or impossible since they are

typically not stored in any third-party server.

Custodial vs Non-Custodial Wallets: Which is Better?

Custodial

and non-custodial wallets have different pros and cons that make them suitable

for different types of users:

- If you are

prone to losing passwords and devices, then it makes more sense to use a

custodial wallet, since an exchange or custodian is likely to have better

security practices and backup options. That’s why it’s a popular option

for beginners who have little to no experience trading crypto. Further,

transaction fees with a custodial wallet tend to be cheaper or even

free.

- However, if you

prefer to retain full control over your own funds, you might want to

consider a non-custodial wallet.

Ultimately,

it all comes down to your choice.

For Additional Security, Consider Multi-Signature Wallets

Multi-signature

wallets – or multisig wallets – are wallets that require two or more private

key signatures to authorise transactions. This solution is useful for a number

of use cases:

- An individual

using a multisig wallet can prevent losing access to the

entire wallet in a case scenario where one key is lost.

For example, if a user loses one key, there will still be two other keys

that are able to sign transactions.

- Multisig

wallets can prevent the misuse of funds and fraud, which makes them a good

option for hedge funds, exchanges, and corporations. As

each authorised person will have one key and a sign-off requires the

majority of keys, it becomes impossible for any individual to unilaterally

make unauthorised transactions.

Any

of the wallet types described above have multisig versions. You can have

multisig hot wallets, cold wallets, hardware wallets, and so on.

Which Crypto Wallet Should You Use?

When

it comes to crypto wallets, there is no perfect solution. Each type of wallet

has different strengths, purposes, and trade-offs. So it’s really up to you to

weigh up what works best for you and your specific needs.

- For those with

a high risk tolerance who want to make regular, quick online payments, the

convenience of a hot wallet would suit you best.

- But if you’re a

little more gun-shy and intend to hold your coins long-term, then a secure

offline device might make the most sense.

- And if it’s the NFT market

that you’re interested in, then you need to look for a wallet that is

compatible with NFT marketplaces such as OpenSea, Solanart, and Crypto.com.

When

choosing a crypto wallet, there are certain factors you should take into

consideration. These include:

- Software vs hardware

- Security features

- How user-friendly it is

- Fees

- Supported coins

- Platform compatibility

- Whether you need DApp and

DEX integration

- Whether the wallet has

backup options

- The wallet’s reputation and

longevity on the market

As

storing large quantities of coins in a single wallet is quite risky, a

combination of cold and hot wallets is usually ideal, and can help you

strike the right balance between convenience and security.

The final

choice remains yours, with the non-custodial Crypto.com Defi Wallet one

of many secure options.