Many people believe Bitcoin to be very complicated, when in fact it’s a lot more simple and intuitive than what most people think. This series aims to help everyone get a grasp of the basics, and over time also present further learning opportunities for those that want to know more.

Bitcoin is often explained by comparing it to something specific people already know, but this is often what creates a lot of confusion.

Bitcoin is a new technology that is unlike anything we have seen before, so a better way to think of it is as a combination of a few different things we are already used to:

Firstly, because it allows you to move money so easily, Bitcoin functions as a payment system, similar to bank transfers or credit cards, only a bit better.

Second, Bitcoin is in some sense similar to gold - that is why many people even refer to it as ‘digital gold’ or ‘Gold 2.0’. Think of it as using gold for money, except it also very easy to move.

Third, Bitcoin is like the internet in that no single person or entity controls it, so anyone can pretty much use it as they like. This gives it some very unique characteristics.

These three characteristics also reinforce one another, so they are all interwoven. But more on all of this in the next few sections. For now, just imagine what would happen if you took a big pot and threw in a credit card, a piece of gold, and a hint of ‘internet’ - mix it all up - and pull out a brand new compound - Bitcoin!

Monday, December 23, 2019

Monday, December 9, 2019

Bitcointalk.org

Bitcointalk is an Internet forum dedicated to the discussion of bitcoin, blockchain technology and cryptocurrency. The forum was initially created by Satoshi Nakamoto, the pseudonymous inventor of Bitcoin on Nov 22, 2009

Satoshi Nakamoto created the bitcointalk forum and posted the first message in 2009 under the pseudonym "satoshi".

The first bitcoin transaction took place at the forum, when software programmer Laszlo Hanyecz offered 10,000 bitcoins to purchase pizza, three days later a deal could be arranged to purchase two pizzas.

The commonly used cryptocurrency-trader meme "HODL" originated from a 2013 bitcointalk forum post.

Initial coin offerings are sometimes announced at the forum.

A 2016 study by researchers from the University of New Mexico, and University of Tulsa, Oklahoma identified 1780 scams, based on forum reports. There is a demand for more privileges for older user accounts. Traded accounts were reportedly used to scam people.

Bitcoin talk is one of the most active forums in the cryptocurrency community. This is a great place for newbies to hang out and get a feel for the crypto community and find tons of amazing information to get them started.

It’s also the perfect place for experts in their field to discuss new innovations and technology and to share knowledge and information with each other regarding the actual project development.

Here, users will find a Reddit style forum set specifically for the discussion of cryptocurrencies, ICOs, and blockchain technology.

There are a lot of “shilling” (crypto speak for marketing) going on here, so you need to weed through what it just marketing talks sometimes. Its not uncommon for ICO projects to post here several times a day trying to lure in investors.

Sunday, December 8, 2019

DOLLAR COST AVERAGING

Dollar Cost averaging is a simple method for long term investing. The idea of this method involves continued effort and interest, along with a strong belief for an asset purchased to be a successful investment opportunity. Often times when markets start to collapse, lose value or stumble across a correction, a common thing happens, panic selling. Panic sellers create opportunity for someone who is looking past short term price swings. In one case for example, an individual or firm may recognize a asset being under bought or under valued. This creates the ability to implement strategies with Dollar Cost Averaging. Here is a couple examples on how DCA works.

When the price of Litecoin was $350 per coin back in 2017, anyone who decided to buy their first LTC at this price would have only a few options, either panic selling when the price began to drop, or implementing a Dollar Cost Averaging strategy for the next 2 years to follow. As the price of Litecoin continued to drop throughout 2018, those who continued buying with strong belief that Litecoin would rise in price again, were able to bring their cost per LTC down to a significantly less value over this period of time. Alternatively, a firm or person could have waited until early 2019 to maximize on their Dollar Cost averaging Strategy by purchasing many Litecoin at $25 or less. So, for example, let’s say 1 Litecoin is bought for $350 in 2017. After the down fall of the market, a person or firm would decide to buy another $350 worth of Litecoin when the coin was $25 in early 2019. Now holding 15 Litecoin for a dollar Cost Average of $46.66, This creates an opportunity to capitalize on the next bull run. Also enables someone confident enough to make a modest return, after taking such a hard loss. Dollar cost Averaging is an Investment strategy, it may not be the most perfect strategy, but it is a valuable technique to learn to remain in the world of markets.

A good method to DCA is continuous buying of an asset in a routine regardless of price, weekly, monthly, yearly.

The most challenging part of this technique is the long belief or commitment to the asset or project you are planning to invest in. Events and news can cause anything to happen, it is best to take a conservative approach, and never to be too aggressive. A good example of Dollar Cost Averaging gone bad would be buying into a company that is going bankrupt, or plans to shut down doors forever, there is also other instances of projects going under. Just keep quality in mind, it is good to find the working products that will be around tomorrow, and forever. DCA strategy may help reduce volatility in a asset purchased. Continued purchasing regardless of price, is also considered Dollar Cost Averaging. This removes the work of trying to time the bottom in a market. Also known as the constant dollar plan.

Monday, December 2, 2019

The best Bitcoin faucet - Moon Bitcoin

This bitcoin faucet review is about one of the most popular bitcoin faucets, Moonbitcoin. It is among the most trustworthy, highest traffic, bitcoin faucets on the internet. It is significant as low traffic bitcoin faucets have lesser chance to pay out as advertising does not make them enough. The huge traffic allows advertisers to create greater payments for ad space, allowing visitors with free bitcoin and ensured payouts. Don’t expect moonbitcoin to go down in alexa rank in the near future.

You can check out Moonbitcoin anytime to claim your bitcoin. You will hear a notification sound when you check the notify inbox. The payouts increase overtime, so the longer you wait to claim your bitcoin, the higher the payout will be. You can also check the website daily to get the loyalty bonus.

You can claim every 5 minutes, but it is wise to always accumulate.

Moonbitcoin Free Bitcoin Faucet Bonuses

Moonbitcoin gives out bonuses, or incentives, to keep users claiming bitcoin.

The faucet bonuses able users to mount up bigger payouts. These are just more reasons why moonbitcoin is preferred to regular bitcoin faucets. Read the list below to know the bonuses currently available:

- Loyalty Bonus: Claiming bitcoin at least one time per day results in an additional 1% for each consecutive day. EX: visit 5 days consistently that is a 5% bonus on every claim.

- Referral Bonus: For each person a user refers to the site, a percentage point is added. 10 referrals = +10% on every bitcoin claim. Additionally, referrals each the referrer 50% of all claims!It lures users to get their friends to sign up and earn bitcoin, boosting moobitcoin traffic.

- Mystery Bonus: At the bottom of the website’s page once you claim your free bitcoin via the faucet, if you click more info it simply shows “?”. Probably, it’s a random bonus.

Moon Bitcoin is part of the Coinpot. You can claim all faucets from coinpot and accumulate in coinpot account. You may exchange the coin to the coin you wanted to achieve the minimum withdrawal limit. Every claim also give you coinpot token.

You can take a look on all the faucets available below

You can take a look on all the faucets available below

STAKECUBE QUICK-BUY

In this tutorial I will show you how you can buy a coin instantly and without fees directly for the market price. Besides, you don't just buy the coin, you also support the project at the same time.

Where do I find the "Quick-Buy" function?

After you logged in, navigate through the wallet overview to the coin you want to buy via "Quick-Buy". If the coin supports the function, you can click on "Quick-Buy" in the sub navigation. You identify which coins are supported by the available apps icons. ( = Quick-Buy)

Requirements

Currently can only support coins listed on StakeCube and Crex24.com

Currently can only support coins listed on StakeCube and Crex24.com

How do i buy coins?

In the Quick-Buy overview you will see all the necessary parameters. There will show you how many coins are available to buy, the current market price (best sell price on exchanges, updated regularly) and of course your account balances.

If there are 'enough' coins available and you have enough Bitcoin in your account, simply enter the quantity you want to buy in the "Amount" field and confirm the transaction by clicking on "Buy". After confirmation, the total BTC value will be deducted from your balance and the coin(s) will be credited to your wallet. Please note the minimum buy quantity below the input field.

The table "STAKECUBE BUYBACKS" shows more details about previous Quick-Buys and Buybacks - Fully transparent and traceable for everyone.

Read more about your benefits and how you simultaneously support the project in the following sections:

What are my advantages?

- One advantage is that you do not pay any fees for your purchase, as usual on exchanges. You get exactly the amount you wanted and the complete BTC (minus network transaction costs) are used to support the project without StakeCube charging or collecting any fees.

- Another advantage: You can simply invest in coins without needing knowledge about how to use a crypto exchange, which makes the entry easier for many new users. The purchased coins are generating stake rewards right away and you can use them in any other function on StakeCube.

- The market price is always pulled from the supported exchanges and guarantees a certain liquidity and protects against overpayment.

How do i support the project with my investment?

Many coins, especially with little volume and little liquidity, facing the problem that buying and selling against the market generates large price fluctuations. Investors and coin developers are very interested in stabilizing the price and making it less volatile. If there is no big demand, even smaller sales can push the price down.

The "Quick-Buy" function, is supposed to strengthen the coin markets and generate potential for (price) growth. To understand how your purchase supports the project, StakeCube shows you exactly what happens when you use the "Quick-Buy" function:

1. User buying coins from the Quick Buy pot. This transaction does not generate a market buy or sale.

2. StakeCube sends 100% of the collected BTC to the supported exchanges. This process operates several times a day.

3. Our script automatically places buy orders into the orderbook of the respective coins. The quantity remains the same, but the price is reduced by a certain difference, to avoid a directly executed trade.

4. These buy order(s) achieves the purpose of Quick-Buy -> a contribution to the price stability and more liquidity.

5. As soon as another user sells his coins on the market and our Quick-Buy order is filled (also called "Buy-Back"), the purchased coins are sent back to the Quick-Buy pot. This process operates several times a day.

6. New coins are now available for purchase and the cycle is complete.

2. StakeCube sends 100% of the collected BTC to the supported exchanges. This process operates several times a day.

3. Our script automatically places buy orders into the orderbook of the respective coins. The quantity remains the same, but the price is reduced by a certain difference, to avoid a directly executed trade.

4. These buy order(s) achieves the purpose of Quick-Buy -> a contribution to the price stability and more liquidity.

5. As soon as another user sells his coins on the market and our Quick-Buy order is filled (also called "Buy-Back"), the purchased coins are sent back to the Quick-Buy pot. This process operates several times a day.

6. New coins are now available for purchase and the cycle is complete.

This process guarantees that coins are repeatedly available for Quick-Buy and supports the projects at a high degree.

Example

You buy 10 StakeCube Coin for 0.00002000 BTC each via Quick-Buy. This will subtract a total of 0.00020000 BTC from your account and you get 10 SCC in return. Next the 0.00020000 BTC are sent to one of the supported exchanges. Our script places a buy order for 10 SCC at a price of 0.00001900 BTC each into the orderbook and contributes its share to price stability. As soon as an other investor/trader sells 10 SCC for this price, they will be sent back to Quick-Buy and can be bought there again without fees at market price.

You buy 10 StakeCube Coin for 0.00002000 BTC each via Quick-Buy. This will subtract a total of 0.00020000 BTC from your account and you get 10 SCC in return. Next the 0.00020000 BTC are sent to one of the supported exchanges. Our script places a buy order for 10 SCC at a price of 0.00001900 BTC each into the orderbook and contributes its share to price stability. As soon as an other investor/trader sells 10 SCC for this price, they will be sent back to Quick-Buy and can be bought there again without fees at market price.

What happens if a buy order is never filled?

Basically, it is not bad if buy orders are not filled, as this improves stability.

But for coins to be available in the Quick-Buy again, the orders have to be filled to send them back to the pot. If this doesn't happen over a longer period of time, StakeCube always has the possibility to adjust the orders manually, or even better: to expand the coin circulation by manually increasing the pot. This is observed individually and adapted to the demand of the respective coins.

Basically, it is not bad if buy orders are not filled, as this improves stability.

But for coins to be available in the Quick-Buy again, the orders have to be filled to send them back to the pot. If this doesn't happen over a longer period of time, StakeCube always has the possibility to adjust the orders manually, or even better: to expand the coin circulation by manually increasing the pot. This is observed individually and adapted to the demand of the respective coins.

Why is only crex24.com currently supported and not the in-house exchange?

In the future StakeCube will integrate a wide array of exchanges, of course also the StakeCube exchange. StakeCube want to build stable order books and liquidity on various exchanges, simply to establish scattered price stability. Another factor is that not all users have access to crex24.com (or other exchanges) for various reasons. Since there are no restrictions on StakeCube, StakeCube wants to create the gateways.

In the future StakeCube will integrate a wide array of exchanges, of course also the StakeCube exchange. StakeCube want to build stable order books and liquidity on various exchanges, simply to establish scattered price stability. Another factor is that not all users have access to crex24.com (or other exchanges) for various reasons. Since there are no restrictions on StakeCube, StakeCube wants to create the gateways.

What is Proof of Work (POW) Mining?

Ever wondered how the mining process on a blockchain works, or how a transaction gets confirmed and is added to the blockchain? So have I. And since I couldn’t find any clear step by step explanation of this process, I decided to write one myself. Here is how a blockchain transaction is processed on a blockchain, in seven steps.

Step 1: A user signs off on a transaction from their wallet application, attempting to send a certain crypto or token from them to someone else.

Step 2: The transaction is broadcasted by the wallet application and is now awaiting to be picked up by a miner on the according blockchain. As long as it is not picked up, it hovers in a ‘pool of unconfirmed transactions’. This pool is a collection of unconfirmed transactions on the network that are waiting to be processed. These unconfirmed transactions are usually not collected in one giant pool, but more often in small subdivided local pools.

Step 3: Miners on the network (sometimes referred to as nodes, but not quite the same!) select transactions from these pools and form them into a ‘block’. A block is basically a collection of transactions (at this moment in time, still unconfirmed transactions), in addition to some extra metadata. Every miner constructs their own block of transactions. Multiple miners can select the same transactions to be included in their block.

Example: two miners, miner A and miner B. Both miner A and miner B can decide to include transaction X into their block. Each blockchain has its own maximum block size. On the Bitcoin blockchain, the maximum block size of one block is 1 MB of data. Before adding a transaction to their block, a miner needs to check if the transaction is eligible to be executed according to the blockchain history. If the sender’s wallet balance has sufficient funds according to the existing blockchain history, the transaction is considered valid and can be added to the block. If a Bitcoin owner wants to speed up their transaction, they can choose to offer a higher mining reward. Miners will usually prioritise transactions such transactions over others, because they provide a better mining reward.

Step 4: By selecting transactions and adding them to their block, miners create a block of transactions. To add this block of transactions to the blockchain (which means having all the nodes on the blockchain register the transactions in this block), the block first needs a signature (also referred to as a ‘proof of work’). This signature is created by solving a very complex mathematical problem that is unique to each block of transactions. Each block has a different mathematical problem, so every miner will work on a different problem unique to the block they formed. Each block’s problem is equally hard to solve. In order to solve this mathematical problem, a lot of computational power is used (and thus a lot of electricity). You can compare it to running a calculation on a calculator, only this is much heavier and on done a computer. This is the process referred to as mining. If you want to know more about how the mathematical problem works exactly (it’s not actually that complicated), please continue reading below, otherwise, in case you want to keep it a little more simple, skip to step 5.

Mining aka hashing (Proof of Work consensus algorithm)

The mathematical problem every miner is facing when trying to add a block to the blockchain is to find a hash output (aka signature) for the data in its block, that starts with a certain amount of consecutive zero’s. That sounds complicated, right? But it isn’t really that hard. Let me try to explain this to you in a simple way.

Before we proceed, it is important to know what a hash function is. A hash function is simply put a mathematical problem that is very hard to solve, but where the answer is very easy to verify.

A hash function takes an input string of numbers and letters (literally any string of random letters, numbers and/or symbols), and turns it into a new 32 digit string existing out of random letters and numbers. This 32 digit string is the hash output. If any number or letter in the input string is changed, the hash output will also change randomly. However, the same string of input will always give the same string of output.

Now consider the data inside a block to be the hash input (a string of data). When this input is hashed, it gives a hash output (32 digit string). A rule of the Bitcoin blockchain is that a block can only be added to the blockchain if its signature, the hash output, starts with a certain amount of zeros. However, the output string generated by an input string is always random for each different input string, so what if the data string of the block does not lead to a signature (hash output) that starts with so many consecutive zeros? Well, this is why miners repeatedly change a part of the data inside their block called the nonce. Every time a miner changes the nonce, it slightly changes the composition of the block’s data. And when the composition of the block’s data changes (it’s input), it’s signature (it’s output) also changes. So every time the nonce of a block is changed, the block gets a new random signature.

Miners repeat this process of changing the nonce indefinitely until they randomly hit an output string that meets the signature requirements (the zeros). Below illustrates this in an example. This example uses seven zeros, but the amount of zeros really depends on the block difficulty of a blockchain. Block difficulty is a little more complicated though, so I suggest you save that for later.

This is how miners need to find an eligible signature to their block, and it is also the reason that so much computational power is needed to solve this mathematical problem. Guessing so many different nonces takes a lot of time and computational power. Also, when more hashing power (miners) joins a blockchain, the difficulty of it’s mathematical problem will increase and lead to higher average electricity expenses to solve a block. Good work if you followed through, now let’s move on to step 5.

Note: This process is actually not defined as a mathematical problem, but rather as a deterministic thing — computers are performing pre-determined operations on a number to see if the output is desirable.

Step 5: The miner that finds an eligible signature for its block first, broadcasts this block and its signature to all the other miners.

Step 6: Other miners now verify the signature’s legitimacy by taking the string of data of the broadcasted block, and hashing it to see if its hash output indeed leads to its included signature of so many zeros (hard to solve, easy to verify, remember?). If it is valid, the other miners will confirm its validity and agree that the block can be added to the blockchain (they reach consensus, aka they all agree with each other, hence the term consensus algorithm). This is also where the definition ‘proof of work’ comes from. The signature is the ‘proof’ of the work performed (the computational power that was spent). The block can now be added to the blockchain, and is distributed to all other nodes on the network. The other nodes will accept the block and save it to their transaction data as long as all transactions inside the block can be executed according to the blockchain’s history.

Step 7: After a block has been added to the chain, every other block that is added on top of it counts as a ‘confirmation’ for that block. For example, if my transaction is included in block 502, and the blockchain is 507 blocks long, it means my transaction has 5 confirmations (507–502). It is referred to as a confirmation because every time another block is added on top of it, the blockchain reaches consensus again on the complete transaction history, including your transaction and your block. You could say that your transaction has been confirmed 5 times by the blockchain at that point. This is also what Etherscan is referring to when showing you your transaction details. The more confirmations your transaction has (aka the deeper the block is embedded in the chain), the harder it is for attackers to alter it. After a new block is added to the blockchain, all miners need to start over again at step three by forming a new block of transactions. Miners cannot continue (well, they can, but that is quite irrelevant in this article) mining aka solving the problem of the block they were working on earlier because of two reasons:

One: it may contain transactions that have been confirmed by the last block that was added to the blockchain (remember, multiple miners can select/include the same transactions(s) in the block they are solving) already. Any of those transactions initiated again could render them invalid, because the source balance might no longer suffice.

And two: every block needs to add the hash output (signature) of the last block that was added to the blockchain into their metadata. This is what makes it a blockchain. If a miner keeps mining the block they were already working on, other miners will notice that the hash output does not correspond with that of the latest added block on the blockchain, and will therefore reject the block.

Sunday, December 1, 2019

Cryptocurrency Exchanges

Before we can take a closer look at how exchanges work, we have to clarify what exchanges are. Exchanges, no matter if they are used for stocks, (crypto-)currencies or other financial instruments, are platforms for traders that bring together supply and demand.

Cryptocurrency Exchanges

For the rest of this article we will focus on cryptocurrency exchanges. Not all exchanges in this field work in the same way, but there are several characteristics most of them have in common.

Fiat to crypto exchange

Some crypto exchanges offer the option to trade fiat currencies (USD, EUR, RUR, etc.) into cryptocurrencies and the other way round.

Trading pairs

All crypto exchanges offer crypto trading pairs in some sort or another. Most common are trading pairs including Bitcoin. Trading pairs with other high volume coins like ETH, XRP or Doge are also very common.

Information and community

Aside the actual trade exchanges can offer information regarding their listed assets. This includes info pages, community forums and in some places even an academy where the user or trader can find educational material for several topics.

Technical indicators

This additional information can also come in form of technical indicators. While some exchanges just offer the price of the coins as a chart or graph over time, some also give the option to apply technical indicators like Bollinger Bands, Oscillators, Moving Averages and several more.

Advantages

Trading cryptocurrencies on exchanges offers several advantages. First of all they usually offer a high variety of different coins to trade with. This gives users the option to trade several coins in one place without having to transfer them between different wallets. Usually the bigger the exchange the more coins they offer for trading. The same goes for the trading volume. Because of their high volumes it’s easy for people to buy coins or to sell them without having to wait for finding a seller/buyer first. Exchanges also offer security in the whole process of the trade. While people could also try to sell their coins to an unknown person outside a marketplace, there’s always the risk that one of the participants in the trade doesn’t fulfill his part. Exchanges will execute the trade for both parties and act as an intermediary to make sure the trade is executed as planned. They manage to do so as in most cases the traders have to keep their coins directly on wallets of that exchange. This gives the exchange the power to securely execute trades without any of the other two parties interfering. Having the coins directly there can also bear technical advantages for their users. Traders that want to invest in several coins can store them directly there without having to install a wallet for each coin on a local computer. In addition most exchanges also offer to manage the private keys for their users, so instead of having to remember and secure several private keys for several different wallets, they usually just need to remember the login data for their account on the exchange.

Disadvantages

What’s easier for users is in some cases also easier for hackers. Storing high amounts of several cryptocurrencies makes crypto exchanges lucrative targets for attacks from hackers. From the traders perspective it’s always good to have some knowledge about how the exchanges used secure their assets. Having most of it in cold wallets and appropriate security measures (2fa, browser check, etc.) in place are important criteria when deciding for an exchange. The disadvantage of offering a high variety of coins and tokens is that, especially among the lesser-known projects, users and traders can fall victim to pump and dump schemes. Here some users come together and increase the price of a project in some cases by several hundred percent. The high rise in price and volume attracts other traders that don’t want to miss out. That’s when the first group starts selling the coins again with high profit to the newly attracted buyers. The latter are usually stuck with the newly acquired coins and only manage to sell them again by taking a high loss. In some cases traders might not see any negative aspects about exchanges until they try to withdraw their funds. Some platforms have very high withdrawal fees or in some cases even withdraw minimums that can prevent or stop users from withdrawing their funds. Here it’s always important to check those fees before depositing any coins on an exchange. In some cases high fees or minimums only apply to certain coins (usually BTC) and not to others. Apart from withdrawal fees there are usually trading fees involved as well. Here it’s always good to compare, as the differences can be very high among different platforms.

Thursday, November 28, 2019

Proof of Burn (PoB)

Proof of Burn (PoB) is a consensus algorithm where "miners" send coins to public addresses that have been randomly generated to become inaccessible and unusable.

By sending the coins to a public address that inaccessible they demonstrate commitment to the network and as such gain the ability to "mine" the next block and validate the transaction. This "mining power" is accumulated as the user burns more and more coins thus increasing the likelihood of being chosen as the next block validator and being rewarded for validating the block.

The reward for validating a block is dependent on the cryptocurrency in question much like PoW or PoS it can awarded at certain intervals but typically the reward covers the amount of coin burned. This virtual mining displaces the actual need for mining hardware found in the Proof of Work (or PoW) blockchains as they are energy inefficient. This accumulation of the cryptocurrency is also similar to Proof of Stake (or PoS) as large holders can burn more tokens thus increasing the likelihood of being chosen as a block validator.

Burnt coins over time begin to "decay" in which the amount burned becomes less and less valuable requiring periodic investment in order to maintain the same level "mining power." This prevents early adopters from dominating the network and incentivizes adoption as it is still viable to participate later in the cryptocurrency.

An additional benefit of removing cryptocurrency from circulation is that it promotes scarcity which in turn creates economic scarcity which can drive the value of the cryptocurrency up. Depending upon the cryptocurrency the coin burned can be the native token, or another more popular cryptocurrency.

The underlying result is the same, something valuable must be expended in order to be rewarded which encourages long term commitment from miners and focuses on decentralization away from computational hardware mining. Typically Proof of Burn is used as a part of in conjunction with other blockchain consensus methods such as Proof of Work or Proof of Stake.

The most common example of PoB would be to remove unspent Initial Coin Offering (ICO) tokens from circulation. This has the benefit of typically raising the price of investors' tokens by restricting the supply further as well as removing the question of what is being done with unsold tokens.

However, Proof of Burn is not without it's own host of disadvantages such as it's relatively recent introduction to blockchain consensus it is still unproven at large scales which means that it's no real world results on it's actual security or efficiency. The process for burning of coin is also rather opaque for the average user, although a user could verify that a burn has taken place on the blockchain usually through an explorer it is difficult to quantify burns across the network unlike PoW which follows hashes or PoS which is typically dictated by wallet sizes.

Another issue that plagues PoB is verification of work (the burning itself) is often delayed because it lacks the speed of PoW or even PoS as the transaction needs to be confirmed before the block can be validated and the work confirmed.

Digital Signatures

Digital signatures are the digital version of handwritten signatures on paper documents. The goal of both kind of signatures is to provide authenticity and to grant that a document or set of data has not been altered on its way from the sender to the recipient (integrity). Digital signatures provide these security measures by using asymmetric cryptography. In contrast to handwritten signatures, that are always the same, digital signatures are unique and differ according to the message that is transmitted.

Hash functions

The main components of digital signatures are hash functions. By using specific algorithms they transform data of any kind and size into a fixed output size. This process is called hashing. As already mentioned they transform arbitrary sized data and transform them into a fix-sized output. These output values are called hashes. Sometimes they are also referred to as hash values, hash codes or digests.

Combining hash functions with cryptography leads to unique digital signatures. Cryptographic hashing, as it is called. Changing the slightest aspect of a message would result in a totally different hash value.

In general we distinguish symmetrical and asymmetrical cryptography schemes. As asymmetrical cryptography is the wider used and more secure way to encrypt messages we will take a closer look at that one.

Asymmetric Cryptography

Asymmetric cryptography, also known as public key cryptography (PKC), uses pairs of keys to encrypt and decrypt messages. Thereby public and private keys are created. As their names already tell, the private key should be kept secure and private while the public key can be spread publicly.

The two main use cases of asymmetric cryptography are digital signatures and the public key encryption. As the latter already suggests, public key encryption uses the public key of the sender to encrypt a message. The message can then only be decrypted by the recipient of the message if he or she is in possession of the corresponding private key. Digital signatures in contrast use the private key of the sender to encrypt the message. Here anybody with access to the corresponding public key is able to decrypt and read the message.

Functionality of digital signatures

In general the digital signature process consists of three main steps or algorithms: key generation, signing and verifying.

The key generation or hashing process runs an algorithm on the data that needs to be signed. The algorithm selects a uniform private key that is randomly chosen from a set of possible keys. The output consists of the private key and a corresponding public key.

The private key in addition with the message data is used as input for the signing algorithm. Both public and private key are provided by the sender of the message. If the public key is not provided in transmitted data the recipient won’t be able to decrypt it.

If the recipient has access to the public key he or she will not only be able to decrypt the message but will also be able to verify the authenticity of that message. The message will have to be encrypted by the senders private key. As he or she is the only one with that key (that’s what we assume) only the corresponding public key will be able to encrypt it.

Goals of digital signatures

- Data integrity makes sure the content of the message has not been altered on its way from sender to recipient

- Data authentication makes sure the recipient can make sure the message came from the sender and nobody else

- Non-repudiation makes it impossible for the sender to deny he or she sent this message

Challenges

The quality of the hash function and cryptographic scheme is crucial for the security of the message. If poor or easy to decode hash functions or algorithms are used it’s easier for hackers to decrypt the message without having access to the corresponding key. Same goes for the implementation of those functions. Even if good algorithms are used, they also have to be implemented and used properly in order to secure the encryption and decryption of the message. The last challenge of digital signatures is the private key. If this key in not kept safe and gets compromised or leaks this can result in huge security issues. For cryptocurrency holders the loss of a private key can lead to big financial losses.

Technical Analysis (TA)

Technical Analysis (TA) is a term used in finance referring to a forecasting method that tries to predict future price and market movements by analyzing market data from the past, mostly price and volume. TA is commonly used on any security, including stocks, futures, (crypto-)currencies, commodities or fixed-income. The only prerequisite here is that historical data is available that can be analyzed.

While the Technical Analysis focuses mostly on recognizing patterns in price movements and recognizing trends, Fundamental Analysis tries to figure out a securities intrinsic value by also evaluating the general economy, earnings, expenses, assets, liabilities and many more.

Main principles of TA

Market discounts everything

According to the Technical Analysis all information regarding fundamental data is already included in and reflected by the current price and can therefore be ignored. The goal here is to understand how other people interpret this information and to analyze the price movements (supply and demand).

Prices move in trends

Probably the most important believe in TA is the assumption that prices move in patterns or trends. This includes short-, medium- and long-term trends. According to this principle it’s much more probable for a price to follow an already started pattern than to break out of it.

History repeats itself

As TA is mostly based on market psychology, the last principle states that history repeats itself. In detail the principle claims that price movements and patterns repeat themselves over a long period of time. It is based on the irrational emotions of investors created by fear or excitement.

In summary TA focuses mostly on the market forces supply and demand. As market data becomes more and more complex traders usually use statistical and mathematical approaches to create indicators to act upon.

Indicators

Traders using TA try to forecast future price movements. Indicators to recognize those include chart patterns, price trends, volume and momentum indicators, oscillators, moving averages and support and resistance levels to name the most common ones. TA indicators are commonly used to create buy and sell signals for traders to act on. Especially in recent years with the rise of Artificial Intelligence (AI) these indicators gain importance as they deliver statistical data that can be interpreted and used by trading algorithms.

Limitations

Especially in the cryptocurrency sector TA has big limitations. First of all the low volumes and market caps of most projects can lead to high volatile markets that can easily be manipulated by a single investor. Secondly the data available to use for that kind of analysis is usually little and doesn’t reach back far enough to recognize long term trends. Finally most of the assets in a currency are still held by few investors which gives them the opportunity to manipulate prices and volumes.

Looking at general security markets TA sometimes creates a self fulfilling prophecy. A lot of TA traders will put their buy and sell orders according to the patterns they start to recognize. The more traders act like that the higher is the probability that this pattern will show up in the end as many traders will act according to it already.

Monday, November 25, 2019

COMPOUND INTEREST

Compounding, usually refers to the rise in value of an asset from interest earned on the initial principle down with accumulated interest over time. Resulting in a time & asset evaluation, also known as Compound Interest. While compound Interest increases the value of an asset more passively, On the opposite, a loan can cause a negative interest effect on a individual who decides to take a loan.

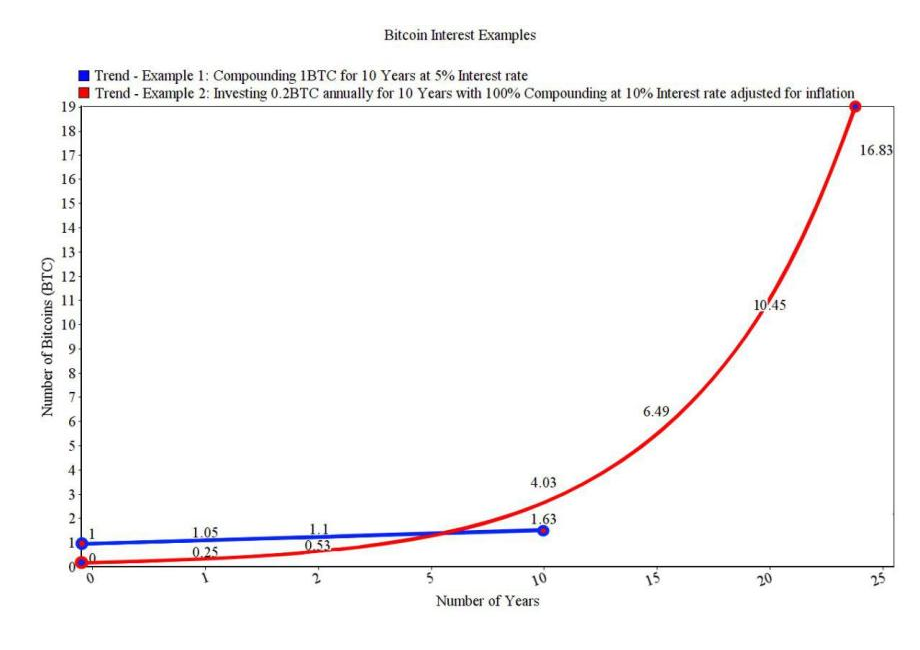

To explain how compounding provides incentive to holding long, lets say 1 BTC is held in a wallet that pays 5% interest annually. After the first year, the total balance in the wallet has gained up to 1.05 BTC, a reflection of 0.05 BTC in interest added to the 1 BTC principle, the wallet gains 5% growth on the original principal (1 BTC) and the 0.05 BTC of first year interest, resulting in a second year gain of 0.0525 BTC and a balance of 1.125 BTC after the first 2 years. As long as no withdrawals take place, and a steady 5% interest return remains. The wallet balance would grow to 1.625 BTC in 10 years, creating a steeper compound curve with time and value.

Here is a curve chart drawing, showing a alternative basic method of compounding over time. Resulting in significant growth.

With the above example you may see that holding an asset long, pays a bigger return over time. The longer you may hold the better in most cases. This is of course subject to risks, companies may go bankrupt, houses catch on fire, and nothing is fail proof. The risk must be considered, and is apart of the equation and evaluation of a long term held asset, each sector has a basket of risks included.

Compounding has been around for hundreds of years. As time moves along, and technology evolves, the common person has access and more options in relation to compounding investments. In example, things like real estate, dividend stocks, and verifying crypto transactions are currently some of the most popular selections.

Another example of compound interest is called income investing, usually offering some sort of return on investments also known as ROI. Historically these type of investors find a way to use the income generated from one asset, to supply funds to put into another income investment. Resulting in a diversified portfolio and more than one stream of income from your investments. This also helps balance risk. When diversified properly between sectors, one asset may be down in market evaluation, while another asset, from a different sector, may be up in market value. This creates a more balanced approach, along with more flexibility, also eliminates a layer of risk involved like holding all eggs in one basket as a example.

Compound Interest, income investments, and alternative cash flow sources of income can help create financial independence, establishing a nice form of retirement pensions, and provide a long term growth portfolio. Enabling the normal person the opportunity to have financial freedom. Compounding creates a way to have a passive income with out doing any back breaking work.

DELEGATED PROOF OF STAKE (DPoS)

Delegated Proof of Stake (DPoS for short) is a blockchain consensus designed with maximum decentralization and engaged users.

It was created as a direct response to the energy use of Proof of Work (PoW) cryptocurrencies and their tendency toward centralization. Users use their stake of coin to vote for Witnesses and Delegates (Some cryptocurrencies have one or the other or both) that govern the blockchain.

Witnesses essentially are trusted validators of transactions that as awarded for every transaction. This also creates network stability as missed blocks are automatically processed by the next Witness. Witnesses cannot change the content of transactions, and any malicious behavior is immediately handled by voting the Witness out of the position. If a Witness proves to be a unreliable validator and not having stable uptime, they can also be voted out of their position. Waiting in the wings are a large group (usually without limit) of backup witnesses looking to step into the limited active Witness slots to ensure the network continues to transact without instability. Backup witnesses are also compensated but at a much reduced rate than Active Witnesses.

Meanwhile Delegates are voted into power the same way Witnesses are however they are not responsible for validating transactions (and thus not paid) but instead are responsible for pushing changes to the blockchain covering things like transaction fees, witness pay, block intervals, block sizes, and other network conditions.

When a change is proposed by delegates, the network is allowed to vote on the changes to the network and the delegates themselves. The voting ensures that both Delegates and Witnesses are incentivized to act in the best interest of the network or risk reputational or financial loss. This makes DPoS unique in that every user's voice can be heard through the voting process when witnesses and delegates validate or change the network.

Unlike PoW where small miners cannot affect the network unless they gather together in large pools of miners which leads to further centralization of consensus and makes the network far less secure.

PoS likewise excludes the smallest of stakeholders from influencing network changes unless you reach a certain threshold which is largely undemocratic.

Thursday, November 14, 2019

Proof of Stake

Proof of Stake (short-handed to PoS) is a blockchain consensus method originally intended to create an alternative to Proof of Work (PoW) which uses intense computation of mathematical puzzles to validate transactions and draft new blocks. Staking allows miners (known as Stakers) to create a fully distributed blockchain based around the random selection and length of time of a locked set of coins known as the Stake to validate transactions and create new blocks, rewarding users for holding coins in their wallets at predictable if somewhat random rate.

Another benefit of PoS over PoW is that it is energy efficient, only using enough energy to run the wallet software and the network connection to it instead of high intensity mining hardware designed to compute the puzzles that validate transactions in PoW. PoS only allows the staker to gain a percentage of the total amount of coins staking at that moment. For example, if you stake 10 coins and the total network has 100 coins staking then you would be rewarded for approximately 10% of the transactions in the network. The specifics of the amount rewarded differs from cryptocurrency to cryptocurrency, some coins will have an escalating series of rewards based on the block height (number of blocks transacted) whereas some coins will have a fixed interval over the life of the network. This creates a predictable rate of interest for the staker as well as the inflation rate of the coin as the network ages and gains maturity making it a popular choice for users who want long term cryptocurrencies that they can hold and help incentivize securing the network.

Additionally, because it is possible for even the smallest (although statistically unlikely) stakes to generate rewards this creates a much more egalitarian and fair distribution model as more participants in the network can be incentivized, this creates a stronger, more decentralized, and secure network. This is especially when compared to other consensus algorithms such as PoW where large spikes in mining difficulty can effectively remove small miners from the network due to infrastructure costs of running mining equipment far outweigh the ability of miners to generate revenue.

However Proof of Stake isn't without it's criticisms, many experts on blockchain argue that PoS creates an incentive for "Fake Stake" attacks in which poorly written or secured code can have negative repercussions on the network by allowing bad actors to essentially fake the size of their stake to generate rewards.

Another criticism of PoS is the inflexibility of transacting coins when staked in a wallet, unlike PoW where puzzles are solved by dedicated hardware and coins can transact freely. PoS requires coins to be locked often for long periods of time in order to generate rewards for the user for validating transactions. This has the plus side of making the network and often the price very stable but often at the expense of market volume and liquidity.

Delegated Proof of Stake (known as DPoS) attempts to address some of these concerns by adopting a model of trusted nodes called "Witnesses" that help secure the network from bad actors.

Wednesday, November 13, 2019

STAKECUBE - the shared masternode and POS pool

POS or Proof of Stake coins are growing more and more popular but a lot of people cannot afford to own enough coins to get a reasonable return or own their own Masternode. For the uninitiated, POS is where you hold your coins in wallet and 'stake' them and receive extra coins as a result. This can be quite profitable, but of course the value of a coin can itself decline as well as go up.

StakeCube is a POS Pool, probably the most user-friendly of all of them and have some unique POS pool benefits for being early adopters.

The benefits of staking in a pool is that you do not have to keep lots of wallets open 24/7 saving on electricity and you can benefit from higher rewards than if you staked alone. You can even stake small amounts of coins and benefit from being in a large pool.

You don't have any coin to stake? No problem, there is faucet features in StakeCube that you can claim some coins and automatically staking after your claims.

StakeCube taking 3% fee (from Stake profits - you never pay anything to them) and 1% for airdrops and lottery. Everyone will get an airdrop of all coins, even coins you don't hold and you can then stake these. You can see the compounding benefits of this.

The GUI / User interface is absolutely superb with all the information you would want, and literally everything is transparent and can be followed on the Blockchain. You can see what percentage of each pool you own. You can withdraw your coins at any time and with zero fees.

To deposit coins you simply click on the coin name and an in-browser window pops up with a deposit address as well as lots of other useful info about the coin including which exchanges support these coins - that's important as lots of POS coins are quite small and will not be on the larger exchanges. Any coins you do deposit can also be added to a pool Masternode for greater returns.

There are more than 40 coins listed on Stakecube.

And wait!!

Besides staking and masternode rewards, there are also interest paying out for BTC, DOGE, LTC and DASH for 7.0++% interest annually. This means, you will get around 0.02% of interest of the coins in your StakeCube Wallet.

StakeCube has its own exchange platform. You can exchange your coins on the platform.

Subscribe to:

Posts (Atom)